- Navy Federal Mobile Deposit Special Endorsement Missing

- Navy Federal Mobile Deposit Treasury Check

- Navy Federal Mobile Deposit Cut Off Time

While overseas, you can make deposits using the Mobile Deposit feature in our app.

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube. Mobile Deposits Deposit personal and business checks safely and securely from anywhere with your phone or other mobile device.—all without having to visit a branch or ATM. Mobile Check Deposit AustraliaFor more information about Navy Federal Business Services, visit Navy Federal Credit Union (NFCU) online https://www.navyfedera. Mobile Deposits - Terms and Conditions (Consumer) This Mobile Check Deposit User Agreement (Agreement) contains the terms and conditions for the use of Navy Federal’s Mobile Deposit Service. Other agreements you have entered into with Navy Federal, including the Navy Federal Important Disclosures booklet, as applicable to your Navy Federal. Deposit History We keep a history of your Mobile Deposits and check images for 10 days. Information on the deposit will also be available in transaction history of the account you deposited to.

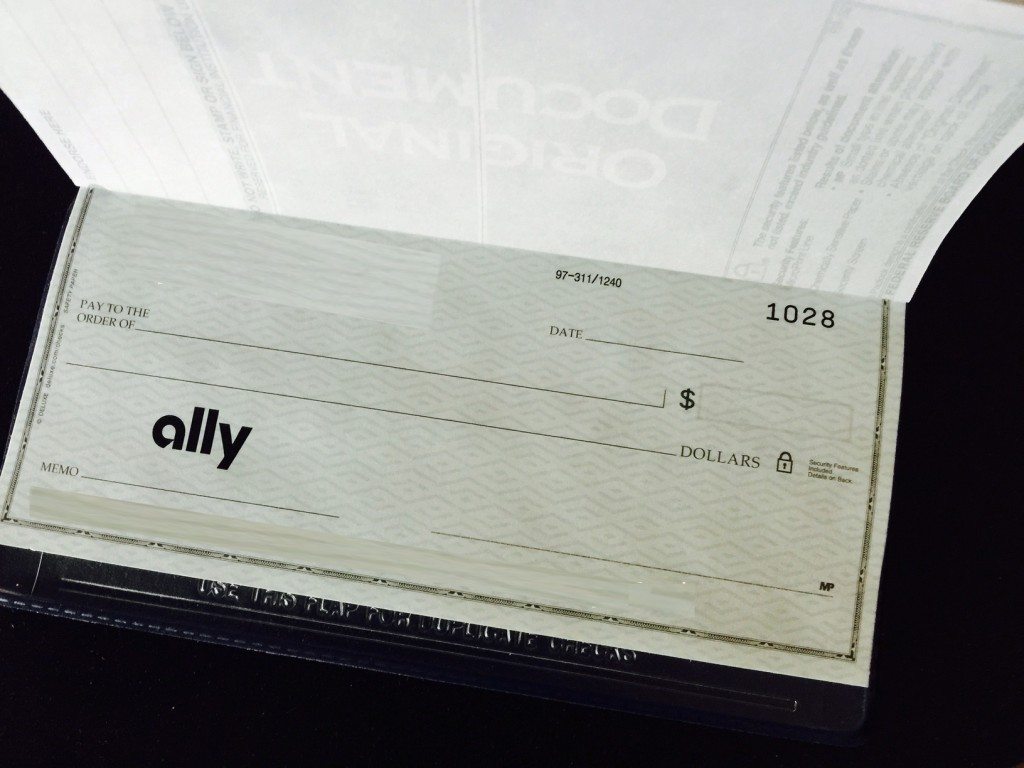

We accept any check that is drawn on a U.S. financial institution in U.S. dollars for Mobile Deposit; this includes:

- Personal checks

- Corporate/business checks

- Cashier's checks

- Government checks

The following are not eligible for mobile deposits:

1. Checks or items containing an obvious alteration to any of the fields on the front of the check or item which you know or suspect, or should know or suspect, to be fraudulent;

2. Checks or items drawn or otherwise issued by you or any other party on any of your Navy Federal accounts;

3. Checks or items not payable in United States currency;

4. Checks or items drawn on financial institutions located outside the United States;

5. Checks or items previously converted to a substitute check;

6. Money orders and travelers checks;

7. American Express® Gift Cheques;

8. Savings bonds;

9. Checks that require authorization (e.g., COMCHEKS, BranchPay, RapidDrafts);

10. State-issued registered warrants;

11. Checks from a closed account at another financial institution; or

12. Checks or items that are incomplete.

Mobile Deposits

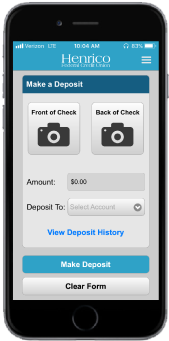

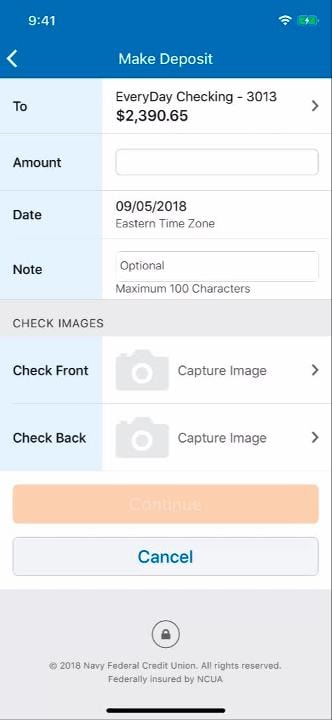

- Download our free mobile* app (available for Android, Kindle Fire, iPhone and iPad).

- Sign in to your Navy Federal account within the app.

- Tap the “Deposits” button and follow the instructions.

Click to see full answer.

Similarly, it is asked, how long does mobile deposit Take Navy Federal?

However, if you make a deposit on a day that is not a Business Day, or make a deposit after the cutoff time, we will consider the deposit to have been received on the next Business Day. For deposits at Navy Federal ATMs, the cutoff time is 12:00 noon, Eastern Time.

Navy Federal Mobile Deposit Special Endorsement Missing

can I Mobile deposit a copy of a check? Substitute ChecksHowever, if a check bounces, your bank does not have the original to return to you. Banks create a substitute version of the check that looks much like a photocopy but has the account number printed on it using magnetic ink. You can cash or deposit these substitute checks without restriction.

Furthermore, how do you endorse a check to mobile deposit?

Yes, please prepare your check for mobile deposit in one of the following ways: Endorse the back of your check with your signature and write 'FOR MOBILE DEPOSIT ONLY, BANK OF GUAM.' Endorse the back of your check with your signature and check mark the box for mobile deposit.

Navy Federal Mobile Deposit Treasury Check

Does Navy Federal accept endorsed checks?

Navy Federal Mobile Deposit Cut Off Time

Navy Federal reserves the right to: accept or reject any check for deposit. require that the space reserved for endorsement by Navy Federal on the back of any check accepted for deposit be free and clear of any prior markings or endorsements.