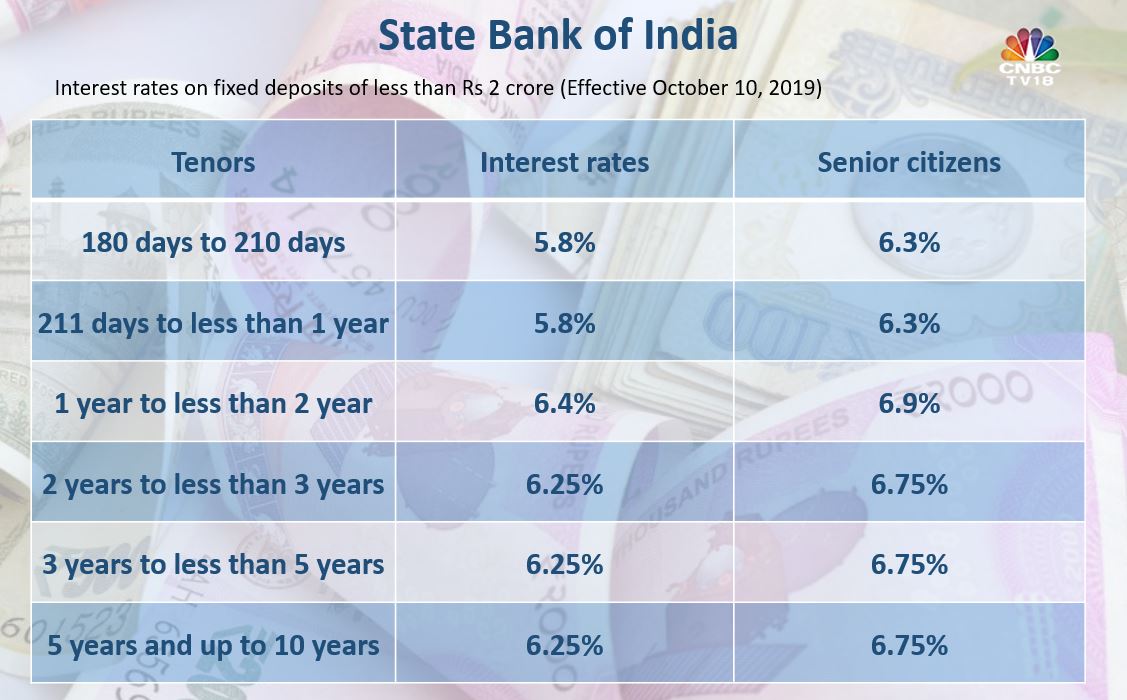

India’s largest lender State Bank of India offers eight maturity options for retail fixed deposits, or fixed deposits up to Rs 2 crore. The maturity period starts at seven days and extends to as long as 10 years.

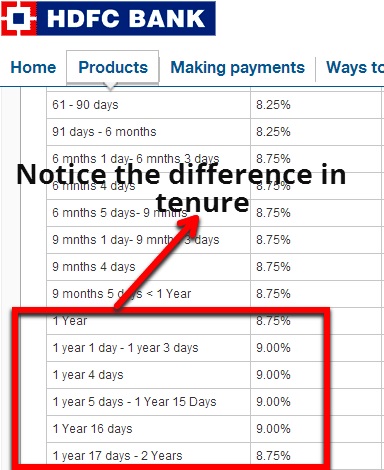

With this, the HDFC bank has as well revised the interest rates of Fixed Deposits starting from 18th May 2020. As per this website, the Fixed Deposits of different tenures will now get interest rates within the range of 3% to 5.75% per annum, and the senior citizens will get 3.5% to 6.5%. HDFC Fixed Deposit (FD) Rates 2021 Updated on February 24, 2021, 6258 views. HDFC Bank is one of the largest private sector lenders on the Basis of assets. HDFC offers a Savings Account, fixed deposit and current deposit services to customers in order to increase their investments in a short time or a specific time.The FD option offered by HDFC. HDFC bank FD interest rates revision from: For HDFC bank, single Fixed deposit of less than ₹ 2 crore, single Fixed deposit between ₹ 2 crore to ₹ 5 crore has been shown here.

Rates Effective from February 13 th, 2020.For Cumulative otion inerest is compunded annually As regards deposit taking activity of HDFC Limited, the viewers may refer to the advertisement in the newspaper/information furnished in the application form for soliciting public deposits. Corporate Fixed Deposit. Company Fixed Deposit (corporate FD) is a term deposit which is held over fixed period at fixed rates of interest. Company Fixed Deposits are offered by Financial and Non-Banking financial companies (NBFCs). The maturities of various company fixed deposits can range from a few months to a few years.

SBI offers interest rates of 2.9 percent to 5.4 percent to its general depositors and 3.4 percent to 6.2 percent to its senior citizens’ customers on retail FDs.

SBI changes interest rates from time to time on the basis to align them with benchmark rates. These interest rates are effective from September 10.

Check out SBI fixed deposit rates:

| Maturity Period | General | Senior Citizen |

| 7 days to 45 days | 2.9% | 3.4% |

| 46 days to 179 days | 3.9% | 4,4% |

| 180 days to 210 days | 4.4% | 4.9% |

| 211 days to 365 days | 4.4% | 4.9% |

| 1 year to 2 years | 4.9% | 5.4% |

| 2 years to 3 years | 5.1% | 5.6% |

| 3 years to 5 years | 5.3% | 5.8% |

| 5 years to 10 years | 5.4% | 6.2% |

India’s largest private sector lender HDFC Bank on fixed up Rs 2 crore, 12 maturity options are offered with varied interest rates by HDFC Bank. The maturity period starts from 7 days up to 10 years. Bank provides 2.5 percent for 7 to 14 days to general customers and an additional 0.5 percent to senior citizens on fixed deposits. HDFC Bank revised its interest rates on fixed deposits with effect from November 13, 2020.

| Maturity Period | General | Senior Citizens |

| 7-14 days | 2.5% | 3% |

| 15-29 days | 2.5% | 3% |

| 30-45 days | 3% | 3.5% |

| 46-60 days | 3% | 3.5% |

| 61-90 days | 3% | 3.5% |

| 91 days – 6 months | 3.5% | 4% |

| 6 months – 9 months | 4.40% | 4.90% |

| 1 year 1 day – 2 years | 4.90% | 5.40% |

| 2 years 1 day – 3 years | 5.15% | 5.65% |

| 3 years 1 day – 5 years | 5.30% | 5.80% |

| 5 years 1 day – 10 years | 5.50% | 6.25% |

Mean-while, India on Tuesday recorded 31,118 new cases of the coronavirus disease (Covid-19), which pushed the nationwide tally to 9,462,809, according to a Union health ministry update at 8 am.

The number of active cases dropped further, to 4,35,603, while 88,89,585 patients were discharged from hospitals in the last 24 hours, health ministry data showed. The number of recovered patients has now reached.

The country recorded 482 new fatalities due to the infection in the past 24 hours, the ministry said. With this, the death toll has reached 1,37,621.

India has conducted 140 million tests to detect Covid-19 in the past 11 months, of which 10 million tests were performed during the past 10 days alone, government data shows.

Hdfc Limited Fixed Deposit Rates

The first test to diagnose Covid-19 in the country was performed on January 23, and on Monday, India performed about 900,000 tests in a single day.

India’s coronavirus tally had crossed the 9.4 million-lakh mark after 38,772 new infections were reported on Monday, as per the health ministry data.

On Sunday, the ministry had said that the national recovery rate stands at 93.71 percent. It also said that India continues to have one of the lowest deaths per million population globally (presently 99).

India’s largest lender State Bank of India offers eight maturity options for retail fixed deposits, or fixed deposits up to Rs 2 crore. The maturity period starts at seven days and extends to as long as 10 years.

SBI offers interest rates of 2.9 percent to 5.4 percent to its general depositors and 3.4 percent to 6.2 percent to its senior citizens’ customers on retail FDs.

SBI changes interest rates from time to time on the basis to align them with benchmark rates. These interest rates are effective from September 10.

Check out SBI fixed deposit rates:

Maturity Period

General

Senior Citizen

7 days to 45 days

2.9%

3.4%

46 days to 179 days

3.9%

4,4%

180 days to 210 days

4.4%

4.9%

211 days to 365 days

4.4%

4.9%

1 year to 2 years

4.9%

5.4%

2 years to 3 years

5.1%

5.6%

3 years to 5 years

5.3%

5.8%

5 years to 10 years

5.4%

Hdfc Fixed Deposit Rates 2020

6.2%

Source: sbi.co.on

India’s largest private sector lender HDFC Bank on fixed up Rs 2 crore, 12 maturity options are offered with varied interest rates by HDFC Bank. Maturity period starts from 7 days up to 10 years. Bank provides 2.5 percent for 7 to 14 days to general customers and an additional 0.5 percent to senior citizens on fixed deposits. HDFC Bank revised its interest rates on fixed deposits with effect from November 13, 2020.

Maturity Period

General

Senior Citizens

7-14 days

2.5%

3%

15-29 days

2.5%

3%

30-45 days

3%

3.5%

46-60 days

3%

3.5%

61-90 days

3%

3.5%

91 days – 6 months

3.5%

4%

6 months – 9 months

4.40%

4.90%

1 year 1 day – 2 years

4.90%

5.40%

2 years 1 day – 3 years

5.15%

5.65%

3 years 1 day – 5 years

5.30%

5.80%

5 years 1 day – 10 years

5.50%

6.25%

Source: HDFC Bank website