- Central Bank Of India Saving Account Interest Rate 2020

- Savings Bank Interest Rates India

- Saving Account Interest Rate In Bank Of India

Banks offer a range of financial products to their customers to meet their needs. These products also include Savings Account. People park their money with Savings Account for a variety of reasons. The most attractive features offered by a Savings Account are liquidity of funds, provides ATM/Debit card, paying utility bills through standing instructions, platform for net banking, online shopping, viewing statements online and facility of mobile banking.

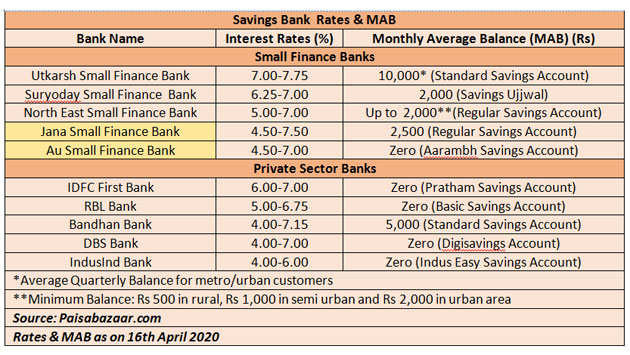

Earlier banks used to offer same rate on their savings accounts Interest rate i.e. 4% per annum and you used to get the same returns with any bank. But during the year 2012, Reserve Bank of India (RBI) has de-regulated interest on savings account and banks are now free to decide on the interest rate that they want to offer on savings account which directly benefits the customers. Due to stiff competition, banks have started paying higher saving interest rates like 6% to 7% in order to attract more and more people to open the account with them and enhance their customer base.

Savings Account Interest rates in 2021 is calculated on daily basis for the closing day balance which will get accumulated and will be paid to the customers on quarterly or half yearly basis. You can use Savings Interest Rate Calculator to calculate your saving interest.

Citizens Charter of Union bank of India Right to Information Act Vigilance & Systemic Improvements Banking Ombudsman Unclaimed Accounts Unclaimed Dividends. Salary Account Demat Account Saving Account Fix. You are here: General General Interest Rate Interest Rates. Interest Rates - Deposit: More. Interest Rates - Loans and Advances. As per data compiled by BankBazaar, new private banks such as Bandhan Bank and IDFC First Bank offer interest rates of up to 7.15 per cent and 7 per cent, respectively on their savings account.

Below list will help you selecting the best savings account in 2021 for parking your money in terms of higher interest rate and other features. It also facilitates you to calculate the interest amount on your deposit.

Important Aspects of a Savings Account that Should Be Kept in Mind

- Interest earned on the savings bank account is taxable. However, Section 80TTA of the Income Tax Act provides for a deduction of upto Rs 10,000 in each financial year. You will be eligible for this deduction whether the saving account is opened with a bank or a post office.

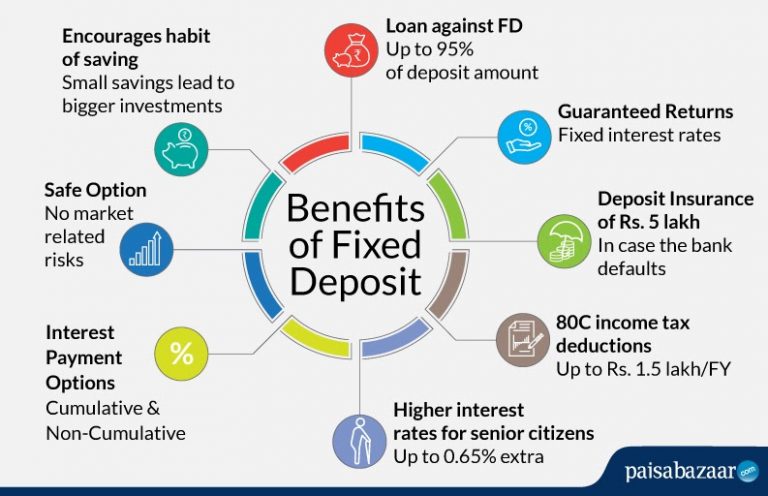

- Most of the banks offer you auto sweep savings accounts which provide a facility in which the bank interlinks your saving bank with a Fixed Deposit account and any excess amount in the savings bank is automatically transferred to the fixed deposit (FD). Under such account, your overall interest on savings account increases.

- You need to maintain a monthly average balance (MAB) in your savings account. If you fail to maintain the same, it attracts a non-maintenance fee. The monthly average balance (MAB) requirement varies from bank to bank and also varies based on whether it is in urban, semi-urban or rural branch.

- Savings accounts impose an upper limits on the number of free ATM withdrawals per month. If your ATM transactions go beyond this limit then they would be chargeable and you need to pay respective fee.

- Whenever there is no transaction in any account for more than a period of 24 months or 2 years, that account is categorised by the bank as a dormant account. Any savings or current account can become dormant due to prolonged non operation. You can reactivate your dormant account in some easy steps.

Saving Account Interest Rate List (as on 06 Mar 2021)

| Bank Name | Rates (p.a.) | Limit | Calculate |

|---|---|---|---|

| Rbl Bank | 6% 6% | Upto Rs 1 Lakh Above Rs 1 Lakh to Rs 10 Lakhs | |

| Dcb Bank | 4% 6% | Below Rs 1 Crore Above Rs 1 Crore to Rs 5 Crores | |

| Yes Bank | 5% 6% | Below Rs 1 Lakh Rs 1 Lakh to Rs 1 Crore | |

| Kotak Mahindra Bank | 5% 6% | Upto Rs 1 Lakh Above Rs 1 Lakh to Rs 1 Crore | |

| Bandhan Bank | 4% 6% | Below Rs 1 Lakh Rs 1 Lakh & above | |

| Indusind Bank | 4% 5% | Upto Rs 10 Lakhs Above Rs 10 Lakhs to Rs 1 Crore | |

| Laxmi Vilas Bank | 4% 5% | Upto Rs 1 Lakh Above Rs 1 Lakh to Rs 5 Lakhs | |

| Idbi Bank | 4% 4% | Upto Rs 25 Lakhs Above Rs 25 Lakhs | |

| Uco Bank | 4% 4% | Upto Rs 50 Lakhs Over Rs 50 Lakhs | |

| Bank Of India | 4% 4% | Upto Rs 50 Lakhs Above Rs 50 Lakhs | |

| State Bank Of Mysore | 4% 4% | Upto Rs 1 Crore Above Rs 1 Crore | |

| City Union Bank | 4% 4% | Upto Rs 1 Lakh Above Rs 1 Lakh | |

| Indian Bank | 4% 4% | Upto Rs 50 Lakhs Above Rs 50 Lakhs | |

| South Indian Bank | 4% 4% | Upto Rs 1 Lakh Above Rs 1 Lakh to below Rs 5 Crore | |

| Union Bank Of India | 4% 4% | Upto Rs 25 Lakhs Above Rs 25 Lakhs | |

| Jammu And Kashmir Bank | 4% 4% | For Any Amount Above Rs 10 Lakhs | |

| Bank Of Maharashtra | 4% 4% | Upto Rs 25 Lakhs Above Rs 25 Lakhs | |

| State Bank Of Hyderabad | 4% 4% | Upto Rs 1 Crore Above Rs 1 Crore | |

| Indian Overseas Bank | 4% 4% | Upto Rs 25 Lakhs Above Rs 25 Lakhs | |

| Tamilnad Mercantile Bank | 4% 4% | Upto Rs 1 Lakh Above Rs 1 Lakh | |

| United Bank Of India | 4% 4% | Upto Rs 50 Lakhs More Than Rs 50 Lakhs | |

| Karnataka Bank | 3% 4% | Upto Rs 1 Lakh Above Rs 1 Lakh to Rs 50 Lakhs | |

| Canara Bank | 4% 4% | Upto Rs 50 Lakhs Above Rs 50 Lakhs | |

| State Bank Of Patiala | 4% 4% | Upto Rs 1 Crore Above Rs 1 Crore | |

| Dhanalakshmi Bank | 4% 4% | Upto Rs 50 Lakhs More Than Rs 50 Lakhs | |

| Oriental Bank Of Commerce | 4% 4% | Upto Rs 25 Lakhs Above Rs 25 Lakhs | |

| Vijaya Bank | 4% 4% | Below Rs 50 Lakhs Rs 50 Lakhs & above | |

| Karur Vysya Bank | 4% 4% | Upto Rs 1 Lakh Above Rs 1 Lakh | |

| Central Bank Of India | 4% 4% | Upto Rs 50 Lakhs Above Rs 50 Lakhs | |

| State Bank Of Travancore | 4% 4% | Upto Rs 1 Crore Above Rs 1 Crore | |

| Federal Bank | 4% 4% | Below Rs 50 Lakhs Rs 50 Lakhs & above upto Rs 10 Crores | |

| Allahabad Bank | 4% 4% | Less than Rs 40 Lakhs Rs 40 Lakhs & above | |

| Punjab National Bank | 4% 4% | Upto Rs 25 Lakhs Above Rs 25 Lakhs | |

| Jammu And Kashmir Bank | 4% 4% | Upto Rs 10 Lakhs Above Rs 10 Lakhs to Rs 1 Crore | |

| Axis Bank | 4% 4% | Below Rs 50 Lakhs Rs 50 Lakhs & above | |

| Corporation Bank | 4% 4% | Below Rs 50 Lakhs Rs 50 Lakhs & above | |

| State Bank Of Bikaner And Jaipur | 4% 4% | Upto Rs 1 Crore Above Rs 1 Crore | |

| Hdfc Bank | 4% 4% | Below Rs 50 Lakhs Rs 50 Lakhs & above but below Rs 500 Crores | |

| Andhra Bank | 4% 4% | Upto Rs 50 Lakhs Above Rs 50 Lakhs | |

| Punjab And Sind Bank | 4% 4% | Upto Rs 20 Lakhs Above Rs 20 Lakhs | |

| Dena Bank | 4% 4% | Upto Rs 25 Lakhs Above Rs 25 Lakhs | |

| Syndicate Bank | 4% 4% | Upto Rs 25 Lakhs Above Rs 25 Lakhs | |

| Icici Bank | 4% 4% | Below Rs 50 Lakhs Rs 50 Lakhs & above | |

| Bank Of Baroda | 4% 4% | Upto Rs 50 Lakhs Above Rs 50 Lakhs | |

| State Bank Of India | 4% 4% | Upto Rs 1 Crore Above Rs 1 Crore | |

| Catholic Syrian Bank | 4% 4% | Upto Rs 1 Lakh Above Rs 1 Lakh to Rs 50 Lakhs |

Central Bank Of India Saving Account Interest Rate 2020

Disclaimer: The Saving Deposit Interest Rates keep on changing. You are advised to check the interest rates with banks before making your savings. Source: Bank WebsitesWho can Open a Savings Bank Account?

- Savings Bank Account can be opened in the name of an individual or in the names of two or more individuals.

- If it is a Joint account, it can be operated jointly or either/ survivor or former/ survivor clause.

- Savings Bank Account can be opened in the name of minor but is required to be operated by natural guardian.

Savings Bank Interest Rates India

Features of Savings Bank Account

- No special rate is offered to senior citizen

- TDS is not applicable

- Nomination facility is available

- Loan against deposit is not permitted

- Interest rate is decided by the bank

Facilities Offered by Savings Account

Saving Account Interest Rate In Bank Of India

- Unique/ Personalized Account Number

- ATM-cum-Debit Card

- Cheque Book

- Pass book/ Bank Statement

- Nomination

- Standing Instructions

- Cheque Collection

- Instant Credit of Outstation Cheque upto Rs.15,000/-

- Internet Banking

- Mobile Banking

- Fund Transfer using NEFT, RTGS & IMPS

- SMS Alerts

- e-Statement

- Several offers and discounts on Debit Card